Before You Buy: 7 Real Estate Terms Every Florida Homebuyer Should Know

If you're buying your first home in Florida—especially in areas like Hudson or Trinity—you're bound to come across some real estate terms that may sound unfamiliar. And during such a big milestone, it’s completely normal to feel a little overwhelmed.

The good news is you don’t have to be an expert in real estate lingo. That’s what I’m here for! But understanding a few key terms can help you feel more confident as we walk through the process together.

Why These Terms Matter

When you know what common terms mean, you can feel more at ease in conversations with your agent, lender, or even the seller. It helps you make informed decisions and avoid confusion down the road. As Redfin puts it: “Having a basic understanding of important real estate concepts before you start the homebuying process will give you peace of mind now and could save you a fortune in the future.”

Let’s explore 7 helpful real estate terms that every Florida homebuyer should know:

📘 1. Appraisal

An appraisal is a professional estimate of a home’s value. Lenders use this to ensure the home is worth the amount being borrowed. It protects both you and the lender from overpaying.

📘 2. Contingencies

These are conditions written into your offer that must be met for the deal to move forward. A common one is a home inspection contingency, which allows you to walk away or renegotiate if serious issues are found.

📘 3. Escalation Clause

Used in competitive markets like Starkey Ranch and Hudson, this clause allows your offer to automatically increase if another buyer outbids you—up to a limit. It helps your offer stay strong without overcommitting.

📘 4. Mortgage Rate

This is the interest rate on your home loan. Even small differences can affect your monthly payment. That’s why comparing lenders and understanding how rates work is important.

📘 5. Pre-Approval Letter

This letter from a lender shows how much you’re qualified to borrow. It signals to sellers that you're serious—and it helps you stay focused on homes within your price range.

📘 6. Earnest Money

Also known as a good faith deposit, this money shows you’re serious about your offer. It’s usually held in escrow and applied toward your purchase if everything goes smoothly.

📘 7. Closing Costs

These are additional costs due at the end of the transaction—things like loan origination fees, title insurance, and more. Budgeting for these upfront can prevent surprises later.

💬 Bottom Line

You don’t need to memorize every term, but understanding the basics can give you clarity and confidence. My goal is to make this journey easier, not harder. So whenever something sounds confusing, just ask—I’m here to guide you.

👋 Have Questions? I love helping Florida homebuyers feel informed and supported. If you’re thinking about making a move—or just want to chat—I’d be happy to help.

📞 Janalene Hiller, Realtor 📍 Starkey Home Group, brokered by Real Broker, LLC

🌐 Visit starkeyhomegroup.com to start your home journey today.

Categories

- All Blogs (325)

- Appraisal Credit (1)

- Buyer Tips (7)

- Escrow (1)

- Financing & Loans (2)

- First time home buyer (5)

- Florida Real Estate (7)

- gardening (2)

- gated community (2)

- Homebuying Resources (3)

- Homes for sale near the beach (3)

- Hudson (3)

- Hudson FL Homes (6)

- Hudson Lifestyle / Homebuyer Tips (2)

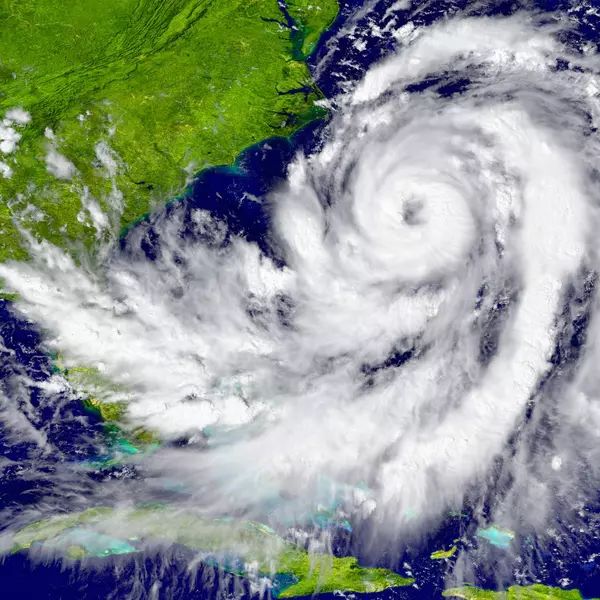

- hurricane preparation (1)

- lawn care (2)

- move in ready homes (2)

- new listing spotlight (1)

- Pasco County (2)

- price reduced homes (2)

- seller tips (4)

- The Verandahs (2)

- VA Buyer (1)

- VA loan (1)

- Veterans & VA Loans (1)

Recent Posts

Hudson, FL Cool-Weather Plant Care: What This Week’s Forecast Means (Dec 29, 2025)

Choosing the Best Yard Orientation for Gardening in Hudson, Florida

Tips for Buyers and Sellers in Hudson, Florida: Navigating Today’s Market

Hurricane Preparedness Guide: Protect Your Home and Family

Just Reduced! Move-In Ready in Hudson, FL – 4-Bedroom Home in The Verandahs for $359,000

Do You Know the Fertilizer Rules in Your Florida Neighborhood?

Smart Home Buying in Florida: What to Know About Wi-Fi, Cameras & Security Before You Close

Before You Buy: 7 Real Estate Terms Every Florida Homebuyer Should Know

VA Homebuyers—Get Up to $750 Toward Your Appraisal!

Discover Hudson, Florida: Home Values, Lifestyle, and Real Estate Trends in 2025

"At Starkey Home Group, we help Florida buyers and sellers move forward with heart and strategy. Whether you're just starting to explore or ready to take the next step, we’re here to guide you with care every step of the way."