Things To Avoid After You Apply for a Mortgage

Some Highlights

- Once a lender has reviewed your finances as part of the homebuying process, you want to be as consistent as possible. Don’t make any big changes that could affect your mortgage application.

- Here are a few tips. Don’t change bank accounts or apply for new credit. And this one may surprise you, don’t buy appliances or furniture for your next home yet either.

- The best tip of all? Before you do anything financial in nature, talk to your lender first.

Categories

- All Blogs (325)

- Appraisal Credit (1)

- Buyer Tips (7)

- Escrow (1)

- Financing & Loans (2)

- First time home buyer (5)

- Florida Real Estate (7)

- gardening (2)

- gated community (2)

- Homebuying Resources (3)

- Homes for sale near the beach (3)

- Hudson (3)

- Hudson FL Homes (6)

- Hudson Lifestyle / Homebuyer Tips (2)

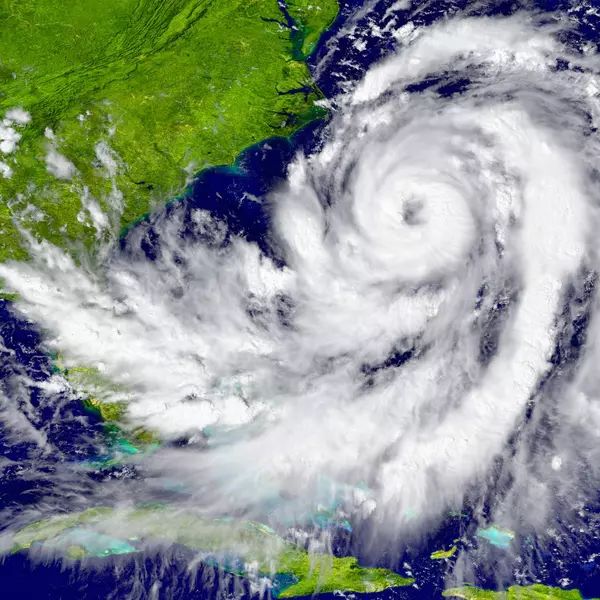

- hurricane preparation (1)

- lawn care (2)

- move in ready homes (2)

- new listing spotlight (1)

- Pasco County (2)

- price reduced homes (2)

- seller tips (4)

- The Verandahs (2)

- VA Buyer (1)

- VA loan (1)

- Veterans & VA Loans (1)

Recent Posts

Hudson, FL Cool-Weather Plant Care: What This Week’s Forecast Means (Dec 29, 2025)

Choosing the Best Yard Orientation for Gardening in Hudson, Florida

Tips for Buyers and Sellers in Hudson, Florida: Navigating Today’s Market

Hurricane Preparedness Guide: Protect Your Home and Family

Just Reduced! Move-In Ready in Hudson, FL – 4-Bedroom Home in The Verandahs for $359,000

Do You Know the Fertilizer Rules in Your Florida Neighborhood?

Smart Home Buying in Florida: What to Know About Wi-Fi, Cameras & Security Before You Close

Before You Buy: 7 Real Estate Terms Every Florida Homebuyer Should Know

VA Homebuyers—Get Up to $750 Toward Your Appraisal!

Discover Hudson, Florida: Home Values, Lifestyle, and Real Estate Trends in 2025

"At Starkey Home Group, we help Florida buyers and sellers move forward with heart and strategy. Whether you're just starting to explore or ready to take the next step, we’re here to guide you with care every step of the way."